About The Book

“Over the years, my team and I have helped thousands of people to address a variety of financial matters in their lives.”

Smart Over Heart

People, Relationships And Your Money

Financial struggles can turn your world upside down, causing tension in relationships and sleepless nights. But there’s hope! Learn to master your money, tackle debt head-on, and sidestep common emotional pitfalls. Drawing from over three decades of financial wisdom and real-world insights, this easy-to-read guide offers practical advice on managing your finances and improving your life. Why wait? Take the first step towards financial peace of mind and a brighter future with Smart Over Heart.

Dive deeper into Smart Over Heart by exploring chapter summaries below. Each link provides a sneak peek into the valuable insights and practical strategies covered in the book.

Smart Over Heart is not a “how to build a financial plan” manual. Instead, it tackles some of the more emotional aspects of personal finance that rarely get addressed even though they can lead to serious challenges.

Topics such as how to handle financial threats, manage emotional decisions, and nurture healthy money relationships do not usually get media attention. However, what good is building a financial plan or buying mutual funds if poor decisions, scams, or harmful relationships sabotage your future?

Planning for the future requires both sound strategies as well as learning how to wisely handle emotional and personal issues. The eleven chapters of Smart Over Heart address these essentials:

Ø Chapter One explores Emotional Decisions and how they can adversely impact our finances.

Ø Chapter Two explores Money Relationships. Finances can be a major source of disagreement for couples and families. Strategies are presented to help reduce conflict and improve outcomes.

Ø Chapter Three provides Wisdom for Windfalls, a step-by-step plan to tackle the difficulties that may arrive with a large influx of money.

Ø Chapter Four offers insights on Planning for Others. Specific techniques are provided on how to give money, create a legacy, and not leave a mess.

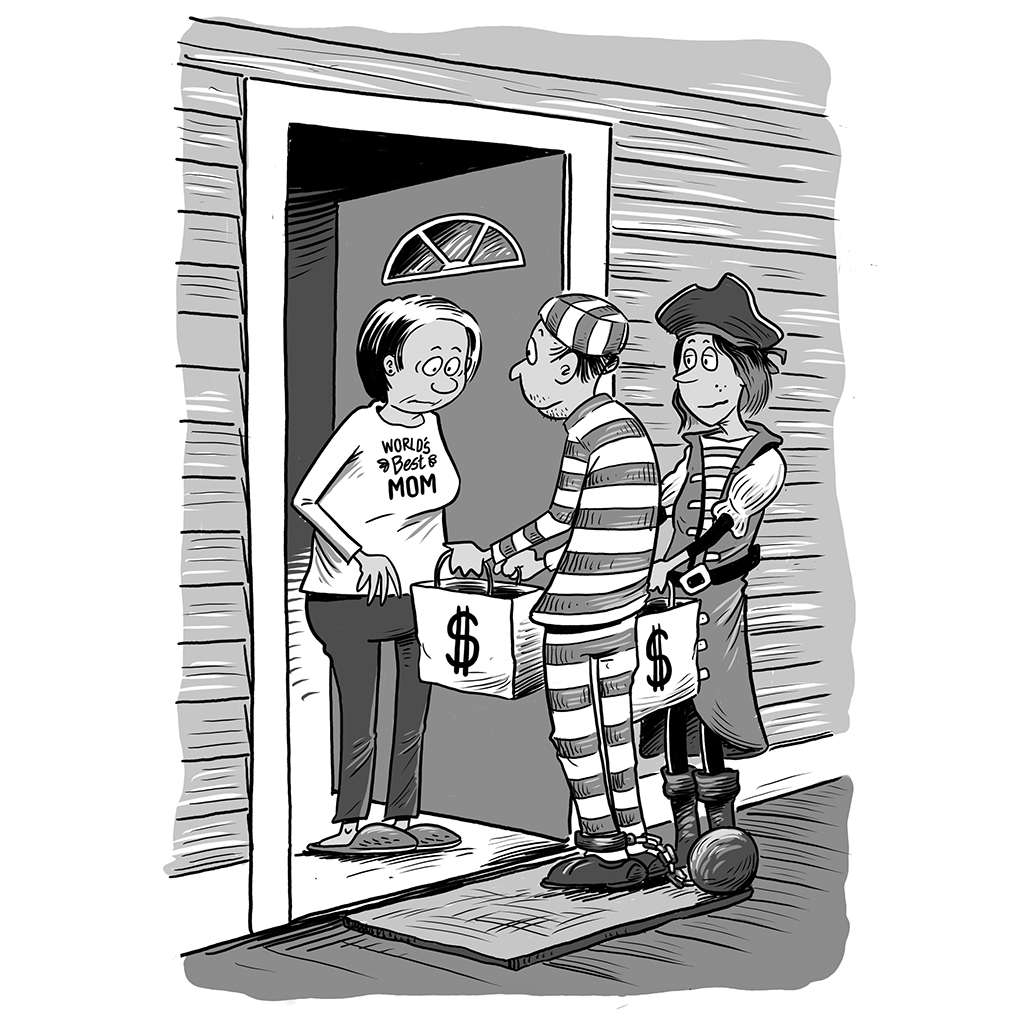

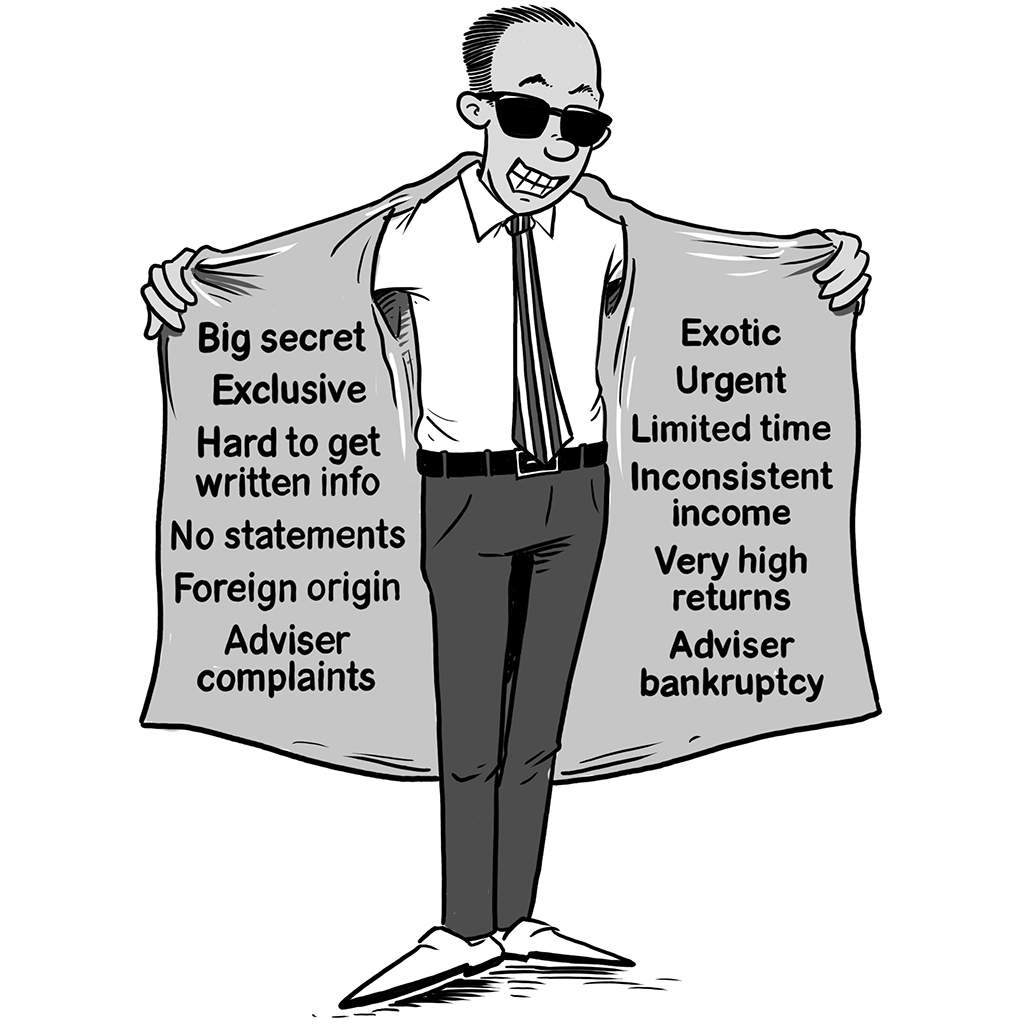

Ø Chapter Five outlines the threat of Financial Scams along with steps to help reduce the risk.

Ø Chapter Six outlines the steps to Manage Cash and maintain adequate liquidity.

Ø Chapter Seven explores practical tips to Understand Debt and to identify debt problems early to resolve them.

Ø Chapter Eight offers a range of solutions to Eliminate Debt for those who are having difficulties with managing and meeting their financial obligations.

Ø Chapter Nine offers insights on how to address Lifestyle Threats.

Ø Chapter Ten provides guidance on how to mitigate or eliminate Investment Threats.

Ø Chapter Eleven explores practical ways to cope with Personal Threats.

Three icons are used throughout the book. First is the “smart owl.” You’ll find him perched next to tips, financial terms, and key concepts as they appear within each chapter.

Second, Frequently Asked Questions are included to help shorten the learning curve on new concepts. The wisdom borne of experience takes time, and mistakes can be costly.

Third, you will find many stories embedded throughout the book. While some are pure fiction crafted from my imagination and experiences, others are real people whose names and situations have been altered sufficiently to preserve their anonymity. In either case, their purpose is to bring life to important concepts and reinforce words of caution.

As you move through the chapters and stories, you will notice that my perspectives on money have been largely shaped by helping people plan their retirements. However, nearly all the topics addressed in this book are just as relevant to those who are still in their working years. Younger adults can especially benefit from the chapters on Cash, Debt, Emotional Decisions, and Windfalls.

It’s time to PlanStronger™ for your financial future . . . by being Smart Over Heart!

I totally recommend you read Smart Over Heart and learn from David Holland. He has a unique way of normalizing issues, helping the reader realize that even the most successful people can have the same difficult personal issues and make the same financial mistakes as everyone else.

I’ve seen no other book that focuses on emotions, decision-making, relationships, and choosing financial professionals, as well as how to deal with financial scams. As David has said, these issues are just as important as investment and financial planning but are often overlooked in the financial field since financial professionals don’t usually make money by addressing these “soft” topics.

Dr. Dorian Mintzer, Ph.D.

Retirement, Money and Relationship Coach, Therapist, Speaker, and Writer. Co-author of The Couple’s Retirement Puzzle: 10 Must-Have Conversations for Creating an Amazing New Life Together. Host of the 4th Tuesday Revolutionize your Retirement Interview with Expert’s Series and weekly podcast series and Owner of www.RevolutionizeRetirement.com.

Ask

The Author

Have questions about Smart Over Heart, finances or retirement? David Holland’s expert team is here to help. Submit your query and we’ll contact you soon. PlanStrongerTV™ fans, we welcome your show ideas too!

Let’s Go! Complete the form below.

Fields marked with an * are required

"*" indicates required fields